Joshka Fischer writes: Until a few weeks ago, Europeans believed they lived in a kind of sanctuary, insulated from the world’s current conflicts. Certainly, the news and images of drowned migrants were dreadful; but the tragedy occurring south of Italy, Greece, and Malta, seemed a long way off.

Syria’s brutal civil war, which has been raging for years, seemed even farther away.

So, sometime this summer, when the last glimmer of hope of a return to Syria disappeared and an alternative to Assad and the Islamic State no longer seemed realistic, these people started heading toward Europe, which seemed to promise a future of peace, freedom, and security. The refugees came via Turkey, Greece, and the Balkan states, or across the Mediterranean to escape similar chaos in Eritrea, Libya, Somalia, and Sudan.

In August, thousands of refugees became stranded at Budapest’s Keleti train station for days on end when Hungary’s vexed and incompetent government deliberately allowed the situation to escalate.

Eventually, thousands of men, women, and children – and even old and disabled people – started to make their way on foot toward the Austrian border. At this point Europe, witnessing an exodus of biblical proportions, could no longer ignore the challenge and the consequences of the crises in its neighboring region. Europe was now directly confronted with the harsh realities from which it had appeared to be a sanctuary.

The European Union lacked the civilian, diplomatic, and military tools needed to contain, let alone resolve, the crises and conflicts in its neighborhood. And, once the migrants headed for Europe, the EU’s common asylum policy failed, because the so-called Dublin III agreement provided no effective mechanism to distribute asylum-seekers among all members states after their initial registration in EU border states (in particular Greece and Italy). Italian Prime Minister Matteo Renzi’s call for European solidarity went unheeded.

Merkel took the brave and correct decision to let the refugees enter Germany. For this, she deserves wholehearted respect and full support, all the more so in view of the icy response of many within her own party. But Merkel was not alone in embodying humane values at this decisive moment. Civil-society groups in Germany, Austria, and elsewhere mobilized to a hitherto unseen extent to meet – together with the public authorities – the enormous challenge posed by the influx. Without the public’s active empathy, the authorities would never have managed. With the support of such ad hoc coalitions, Europe should do whatever it takes to ensure the refugees’ successful integration.

The influx launched during the “refugee summer” will change Germany and Europe. The EU will be able to address the challenge – and seize the opportunity – of integrating the newcomers only together and in the spirit of European solidarity. Should unity crumble in this crisis, the consequences for all parties involved – especially the refugees – will be grave.

First and foremost, a new, effective system for securing Europe’s external borders must be established as quickly as possible. This includes a joint procedure for judging asylum claims and a mechanism to distribute the refugees among EU countries fairly. Moreover, if the EU wants to maintain its core values, including the abolition of internal borders, it will need to focus on stabilizing its Middle Eastern, North African, and Eastern European neighbors with money, commitment, and all its hard and soft power. A united approach will be crucial.

But Europe should avoid the kind of dismal realpolitik that would betray its core values elsewhere. It would be a grave mistake, for example, to sell out Ukraine’s interests and lift the sanctions imposed on Russia out of the mistaken belief that the Kremlin’s assistance is needed in Syria. Cooperation with Russia, however useful and advisable, must not come at the expense of third parties and Western interests and unity. Attempting to redeem past mistakes is not advisable when it means making even bigger ones.

To be sure, there is a risk that the refugee crisis will strengthen nationalist and populist parties in EU member states. But the renationalization of politics within the EU gained traction long before the summer of 2015, and it is not a result of the refugee crisis. At its heart lies a fundamental conflict over Europe’s future: back to a continent of nation-states, or forward to a community of shared values? Convinced Europeans will need to marshal all their strength – and muster all their nerve – in the times ahead.

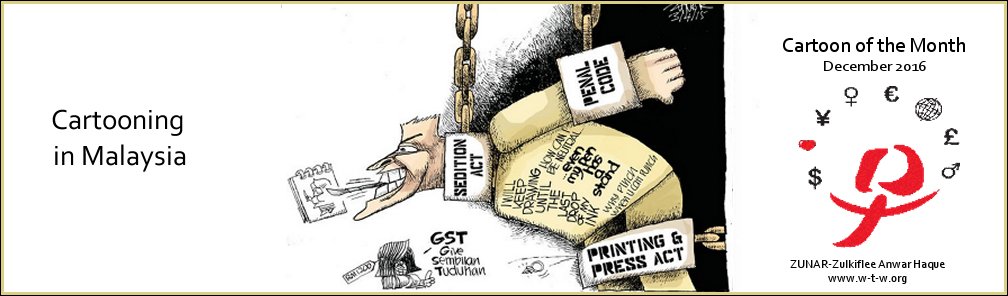

In an interview, Mr. Zulkiflee, 54, discussed how social media has become an increasingly important channel for political dissents, and why he continues to use his art to investigate corruption and injustice.

In an interview, Mr. Zulkiflee, 54, discussed how social media has become an increasingly important channel for political dissents, and why he continues to use his art to investigate corruption and injustice.