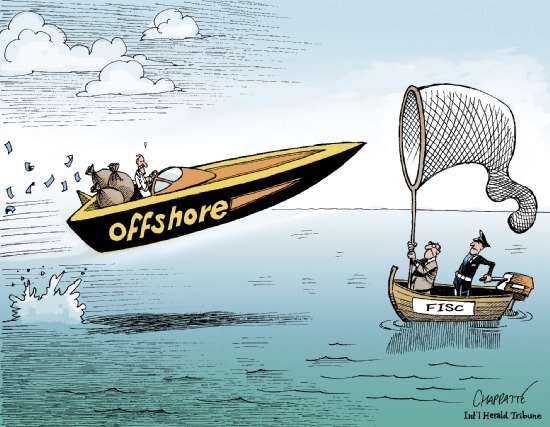

Andreas Frank International Anti-Money Laundering AML Expert Reports:

The latest U.S. Government Accountability Office report shows which states have the most taxpayers disclosing such accounts (California is No. 1), and where they are located (Switzerland is No. 1). The report was published on Jan 6, 2014 but publicly released on Feb 19, 2014.![]()

The GAO report is a supplement to its

“Offshore Tax Evasion: IRS Has Collected Billions of Dollars, but May be Missing Continued Evasion.”

There is nothing illegal about keeping money offshore, but you have to report it on a form called the Foreign Bank and Financial Account (FBAR) form – if the account value is $10,000 or more – and pay taxes on earnings. For those ready to fess up, the IRS held the 2009 voluntary disclosure program, followed by one in 2011, and another that opened in 2012 and is still reeling in taxpayers. The programs offer incentives for taxpayers to disclose their offshore accounts and pay delinquent taxes, interest and stiff penalties – to avoid criminal prosecution.

GAO_Offshore_Tax_Evaders