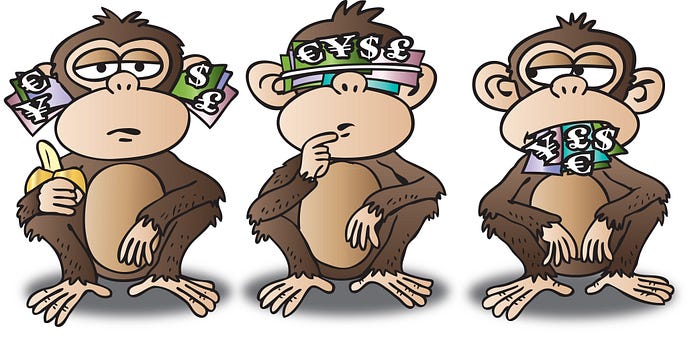

This year’s report explains that a small improvement in risks relating to the quality of countries’ anti-money laundering frameworks is offset by increased risks in four other areas measured by the Basel AML Index: corruption and bribery, political transparency, financial transparency, and political/legal risks.

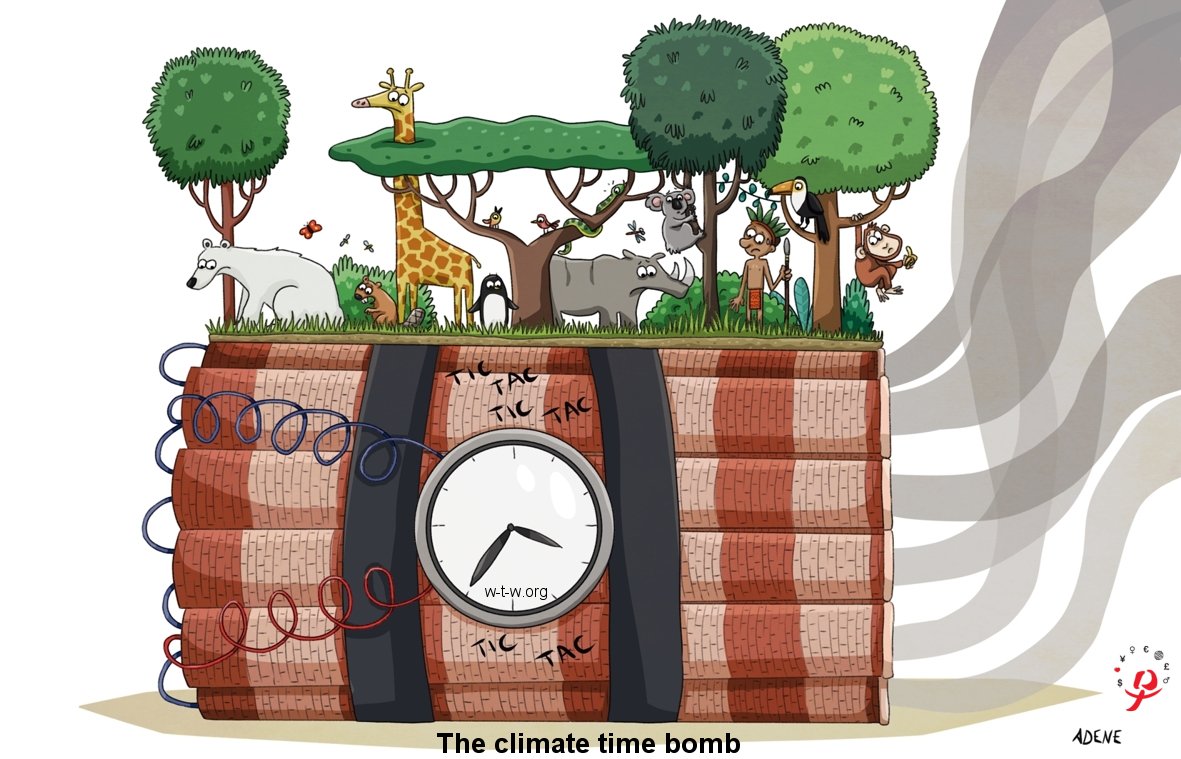

But while money laundering continues to be a major problem from year to year, the factors that contribute to money laundering risk are evolving. One such evolution is the growing realization that money laundering weaknesses are enabling criminals to profit from harming our fragile environment. This is why this year’s Index includes a new environmental crime indicator in its set of (now) 18 indicators.

What does environmental crime exactly have to do with money laundering risk? And what does the initial data show?

Corruption and money laundering are destroying the planet. Environmental crimes like illegal wildlife trade, forestry crimes, illegal mining, and waste trafficking are destroying our natural resources and threatening sustainable livelihoods. Together they are said to make up the world’s fourth largest criminal industry after drug trafficking, human trafficking and counterfeiting. Estimates indicate that environmental crime produces massive illicit proceeds, estimated at $110 billion to $281 billion each year. It is growing at an annual 5–7 percent, more than the pace of global economic growth. While such estimates make numerous assumptions and are thus to be taken with a grain of salt, they nonetheless indicate the scale of the problem.

The global community is only just starting to realise the many roles that corruption plays in facilitating environmental crimes, with some outstanding efforts that lead the charge. Research is also highlighting the myriad ways in which criminals launder the massive illicit proceeds, thereby fuelling our present environmental catastrophe.

The decision to include the environmental crime data was made at the annual review meeting of the Basel AML Index, which draws experts from across sectors and geographies. The review helps to ensure that the methodology continues to be relevant and to reflect current evolutions in the anti-money laundering and counter financing of terrorism (AML/CFT) landscape.

The inclusion aligns with the strong recommendation of the Financial Action Task Force (FATF) that environmental crimes should be considered predicate offences for money laundering. This recommendation in turn echoes statements by other bodies, from the UN General Assembly to the European Union, Eurojust and INTERPOL and the UN Environment Program, that it is essential to tackle the financial drivers of environmental crimes – the corrupt deals and the money laundering that facilitate criminal activity and make it profitable.

Until now, reliable data on countries’ risks of environmental crime were lacking. The Global Organized Crime Index has changed this. First published in 2021 by the Global Initiative Against Transnational Organized Crime (GITOC), the expert-led assessment looks at both levels of criminality and resilience to organised crime in the 193 countries covered.

The Basel AML Index uses data from GITOC’s index on crimes involving flora, fauna, and non-renewable resources such as minerals. The new indicator is assigned a 5 percent weight, matching existing indicators on human trafficking and narcotics trafficking. We are thereby attempting to elevate the importance of this frequently overlooked crime.

Initial insights. Based on the data, the average global score for environmental crime is 3.62 out of 10, where 10 is the maximum risk. This sounds fairly low, but there is great variation between jurisdictions – from the highest risk score of 8.33 (Democratic Republic of the Congo) to the lowest of 0.19 (San Marino and Iceland).

Sub-Saharan Africa has the dubious honour of being the region with the highest risks of both environmental crime and money laundering. Cameroon, the Democratic Republic of Congo, Madagascar, Mozambique, and Tanzania and perform particularly poorly. Next up is the region of East Asia and the Pacific, where environmental crime scores are high for Cambodia, China, Indonesia, Myanmar, the Philippines, and Vietnam.

Interestingly, there is almost 100 percent correlation between a low risk of money laundering and a low risk of environmental crime. Andorra, Finland, Iceland, New Zealand, San Marino, Slovenia, and Sweden, for example, all perform among the best countries in both.

A similar trend, but with a less strong relation, is observed in high-risk countries. For instance, a high risk in the overall money laundering score correlates with high risks of environmental crime for the Democratic Republic of the Congo, Cambodia, Cameroon, China, Madagascar, Myanmar, Mozambique, Vietnam, and Zimbabwe.

What do we need? First, more and better data. While reliable enough to be included in the Basel AML Index, the Global Organized Crime Index is based on expert-led desk research from open sources. While GITOC has gone to some length to reduce these biases, having more than one source of data to rely on would allow for greater research depth.

The FATF and its regional bodies have started to assess jurisdictions’ risks associated with environmental crime as part of their rolling program of mutual evaluations. However, this assessment is conducted only as a part of the existing FATF Recommendation 1 and Immediate Outcome 1 on understanding ML/TF risks and applying a risk-based approach to address them.

More focus on this issue is needed to provide the kind of disaggregated and detailed data we really need on different types of environmental crime and their links to money laundering.

Second, more action. The Basel Institute’s Green Corruption program is seeing fast-growing demand for technical assistance in applying existing tools designed to combat corruption and other financial crimes to tackle environmental crimes.

For example, governments are increasingly realising the value of conducting parallel financial investigations in cases of illegal wildlife trade and forest crimes, as the FATF recommends in the above-linked report. This enables law enforcement officers to identify and disrupt not only the poachers and illegal loggers, but the high-level traffickers and their corrupt facilitators who profit from the crimes. While appreciation for the importance of these parallel investigations is growing, they are still too frequently an afterthought to seizures and arrests.

The countries in which the Green Corruption program is currently active suffer medium to high risks of environmental crimes, according to the Global Organized Crime Index data. Indonesia, our newest country of operation, is evaluated as having a high risk, at 7.41 out of 10. In Latin America, Bolivia and Peru score 6.3 and 6.85 respectively. In Sub-Saharan Africa, Malawi (4.07) and Uganda (6.17) also face significant challenges.

Efforts to address the environmental crimes that are threatening these countries’ sustainable development need to go hand in hand with improving resilience to money laundering…. fcpablog

globalwitness.org/en/campaigns/corruption-and-money-laundering/