Our correspondent Andreas Frank reports: A former Credit Suisse banker pleaded guilty to helping Americans hide money in Switzerland and agreed to cooperate with the U.S. government as it investigates banks and their employees for aiding tax evasion.

Andreas Bachmann admitted to one count of conspiring to defraud the U.S., which carries a potential penalty of five years in prison. Prosecutors agreed to recommend a reduced sentence in return for his cooperation.

In 2011, federal prosecutors accused Mr. Bachmann and seven other Credit Suisse bankers of conspiring to set up offshore accounts for wealthy Americans that hid up to $3 billion in assets, according to the indictment.

US Bachmann PressRelease

Related Reports:

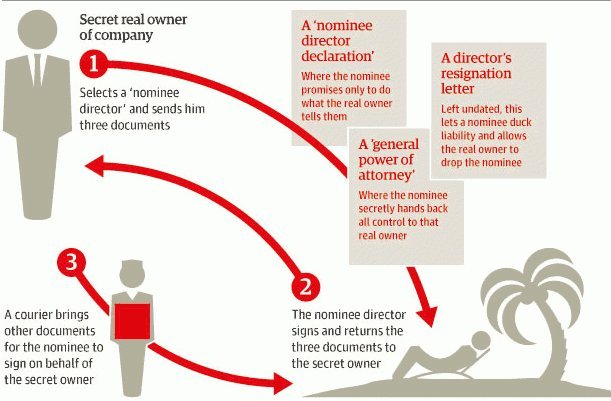

A nominee director is someone who is renting his or her name to hide the beneficial owner by taking the position on paper of the company’s directors. The term of straw man or front man has been used to describe someone who is acting as the nominee. Legally, according to the incorporation documents, the nominee is responsible for the company or entity. In addition, if it is the case of a nominee that is also listed as the nominee shareholder, then they in effect also have the related ownership responsibilities as well.

The basic function of the nominee director is to shield working executives of other companies from the public disclosure requirements. It is designed to help a person who would rather not disclose their interest or association with a given corporate body. Anyone performing a company search on a company with a nominee director would be unable to discover in whose name the nominee director was registered.