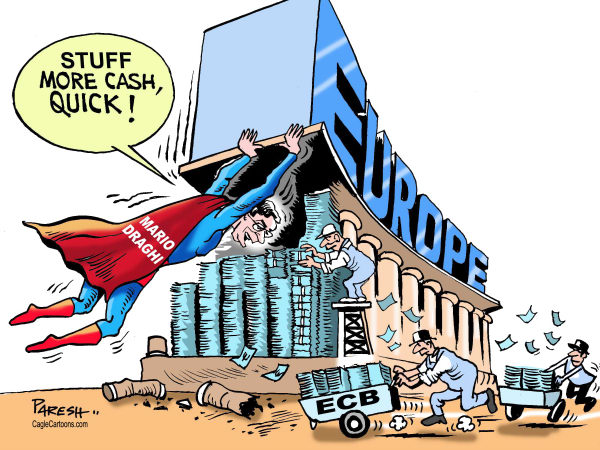

Brian Blackstone writes: The European Central Bank’s president said the ECB will implement its EUR1 trillion-plus quantitative easing program to completion and is even willing to add to it if needed.

Yet investors reacted oppositely to what would have been expected. German bond yields soared, and the euro rose against the U.S. dollar. Easier monetary policies typically reduce yields and currency values.

In a sense, the recent rise in bond yields—though Germany’s 10-year yield, at around 0.93%, is still super low—reflects a normalization in the economy and inflation. Consumer prices are up in the eurozone and returned to positive territory last month faster than many analysts had thought they would. That implies a higher bond premium to safeguard against inflation. Firmer economic growth typically has the same effect on yields. Hopes for a deal between Greece and its creditors have dampened demand for ultra-safe assets like German bonds.

A deeper message from Wednesday’s market reaction to Mr. Draghi’s press conference is that seven years after the onset of the financial crisis, the global economy and financial markets are still highly dependent on monetary policy.

For investors, that means bouts of volatility that central bankers can’t, or won’t, intervene to resolve.

For Mr. Draghi and his peers this means their words still matter greatly whether they like it or not, and need to be chosen carefully.