Last week the chief executive of UBS told all the bankers who work for him that henceforth UBS chief says it is ok to make honest mistakes.

A culture in which everyone was petrified of taking risks, Sergio Ermotti said, was not in the interests of the bank or its clients.

How mature, came the response. How refreshing to hear a bank chief acknowledge that risks need to be taken and honest mistakes will sometimes be made.

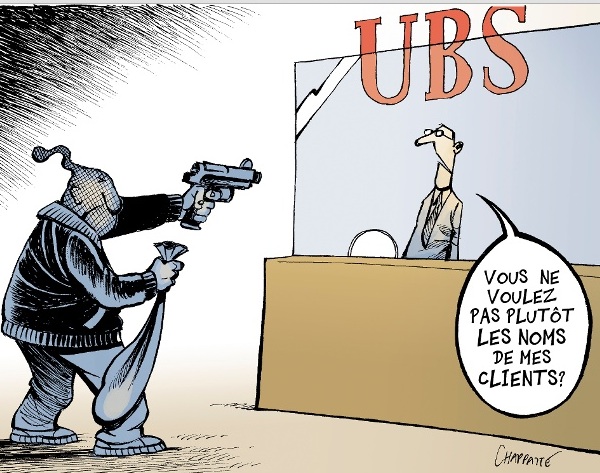

The point is that “This mistake-loving nonsense is an export from Silicon Valley, where ‘fail fast and fail often’ is what passes for wisdom,” but that it is inappropriate in the banking context. Tech is an industry of moving fast and breaking things. Finance is an industry of moving fast, breaking things, being mired in years of litigation, paying 10-digit fines, and ruefully promising to move slower and break fewer things in the future.”

Of course there’s a reason that Ermotti said what he said. A workplace culture of experimenting, taking risks, being unafraid to try new things, not being harshly penalized for messing up is nicer than one of zero-tolerance striving for boring perfection. That’s why people want to work at tech startups and are less keen on working at banks these days. Regulators want to turn banks into utilities — boring and mistake-free — but the bankers look back on their mistakes with nostalgia.

Deutsche Bank prepared to fire traders for Libor manipulation. “Thank you for making yourself available for this call today,” it begins, and then “We have decided that your employment agreement should be terminated with immediate effect by reason of your gross misconduct,” which is the way to do it. Rip the band-aid right off; don’t mince any words about exactly how gross the misconduct was.