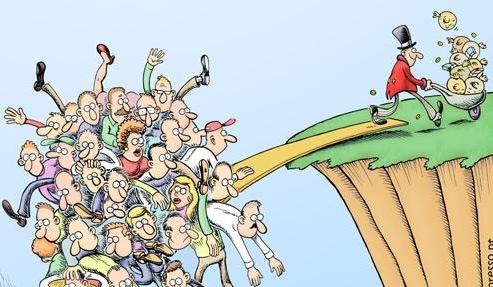

Fed officials believed the “wealth effect” from quantitative easing would benefit the broader economy – akin to the Republican premise of trickle-down economics – by allowing people with more valuable assets to spend more. This has not happened.

The 20 richest Americans have amassed a fortune that is larger than all the wealth of the least wealthy half of the population, 152 million people, according to a recent study by the Institute for Policy Studies, with the biggest income gains coming in the last six years. Since 2009, some 95 per cent of the earnings growth has floated to the top 1 per cent.

Almost 50 per cent of US aggregate income went to upper-income households in 2014, up from 29 per cent in 1970, Pew Research said in a report last week showing a hollowing-out of America’s middle class. The share going to middle-income households has fallen from 62 per cent in 1970 to 43 per cent in 2014.

The Fed’s rate hike may not help alleviate the pain of economic inequality either. Banks and credit unions may decide to keep interest rates on savings low while cranking up rates on mortgages and other consumer loans, using the higher rates to recover fees and boost profits. Fed Uptick on Interest Rates and Inequality