Christine Lagarde will be featured among the keynote speakers at Global Women’s Forum Dubai 2016, taking place on 23rd-24th February at the Madinat Jumeirah in Dubai, under the patronage of Vice President and Prime Minister and Ruler of Dubai, His Highness Sheikh Mohammed Bin Rashid Al Maktoum and led by Sheikha Manal Bint Mohammed Bin Rashid Al Maktoum, President of the UAE Gender Balance Council, President of Dubai Women Establishment and wife of Sheikh Mansour Bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidential Affairs.

Lagarde joined the French government in 2005 as the Minister of Foreign Trade, and became the first woman to hold the post of Finance and Economy Minister of a G-7 country in 2007.

In 2011, Lagarde became the first woman to assume the role of Managing Director of the International Monetary Fund, an organisation of 188 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

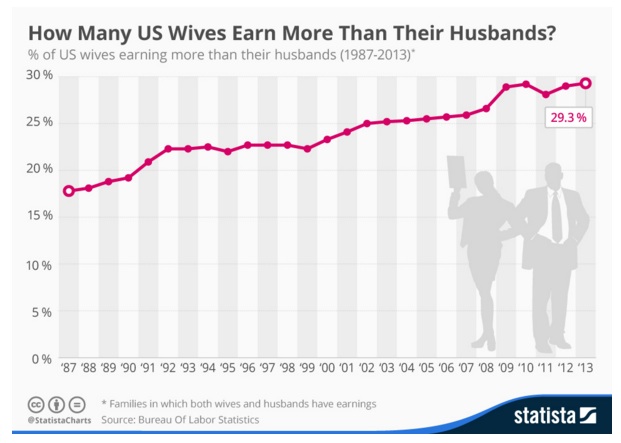

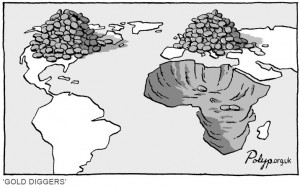

Ranking sixth on the latest Forbes list of the ‘World’s 100 Most Powerful Women,’ Lagarde has championed efforts to increase the participation of women in the workforce as a means of reducing poverty and inequality. In a recent interview, she urged governments to implement policies to improve the education levels of girls and women, pointing to recent IMF data, which demonstrates how countries can increase GDP as a direct result of allowing young girls to access education.

Mona Ghanem Al Marri, Chairperson of the Board of Dubai Women Establishment, DWE, and Vice President of the UAE Gender Balance Council, said, “Christine Lagarde has always been a powerful advocate and voice for enhancing female engagement and participation in the workforce, highlighting the major role that women’s empowerment plays in boosting economic growth. Over the past few decades, the UAE has made great strides in strengthening the influence of Emirati women and achieving gender parity, paving the way for women to play their part in the progress and development of our nation. As we continue on our journey towards achieving gender balance and equality, there is much that we can learn from female leaders such as Christine, and we look forward to welcoming her to Dubai in 2016.”

Global Women’s Forum Dubai 2016, co-organised by the Women’s Forum for the Economy and Society and the Dubai Women Establishment, brings together leaders from around the world, women and men, representing business, government, academia as well as art and culture. The event will highlight new perspectives for today and tomorrow, creating a powerful, global network capable of boosting the influence of women throughout the world, conceiving innovative and concrete action plans to encourage women’s contribution to society, and promoting diversity in the business world.

Building on the theme of innovation, Global Women’s Forum Dubai will move beyond the usual expectations for and reservations about technology to address the sustainable role of women as well as the role tradition can play in innovation. The agenda streams for Global Women’s Forum Dubai fall under five pillars: Achieving, Creating, Giving, Energizing and Sustaining. Each pillar will serve to orient sessions to show how the development of innovative ideas and practices can benefit women, society or the economy. The Discovery, the renowned creativity space at Women’s Forum meetings, will be among the highlights of Global Women’s Forum Dubai 2016.

The Discovery will feature a wide variety of ‘hubs’ presenting complementary workshops and enlightening exhibits to expand upon the numerous concepts discussed during the main panel discussions. CEO Champions, a Women’s Forum initiative launched in 2010 to drive progress and accountability for women’s advancement in the private and public sectors, will also be part of Global Women’s Forum Dubai 2016, in addition to key Women’s Forum initiatives such as Rising Talents, Women in Media, and the Cartier Women’s Initiative Awards.