Preetinder Singh “Preet” Bharara is an Indian American attorney and the U.S. Attorney for the Southern District of New York. His office has prosecuted people worldwide and has prosecuted nearly 100 Wall Street executives.

Bharara has won nine out of 10 cases against a parade of disgraced Albany lawmakers since taking the helm of the Southern District of New York in 2009, prevailing in three trials and garnering six guilty pleas. In his crosshairs were two of New York’s biggest political animals: former Assembly Speaker Sheldon Silver and former Senate Majority Leader Dean Skelos. He has won convictions against both of them.

Mr. Bharara may also be hunting the biggest game of all in New York: Gov. Andrew Cuomo, whom he has criticized for disbanding the Moreland Commission on public corruption. Last week, word broke that Mr. Bharara is investigating $1 billion in funding provided by the governor to help revive Buffalo. Mr. Cuomo said over the weekend that he had no role in awarding the so-called “Buffalo billion” to bidders.

Aggressive and media-savvy, Mr. Bharara portrays himself as the white knight cleaning up the “cauldron of corruption” in Albany. Even in the case he lost, the defendant ended up behind bars. In 2011, a federal jury found William Boyland not guilty, but the Democratic assemblyman was convicted three years later, courtesy of Mr. Bharara’s Eastern District counterpart Loretta Lynch, who is now U.S. attorney general.

“Bharara is on the warpath,” said James Cohen, a criminal-defense professor at Fordham University Law School. “He thinks the whole thing is a sewer, and he’s in a position to make some change.”

To do it, the prosecutor has used techniques perfected in fighting terrorists and organized crime, employing stings, wiretaps, video surveillance and undercover FBI agents to catch politicians in the act.

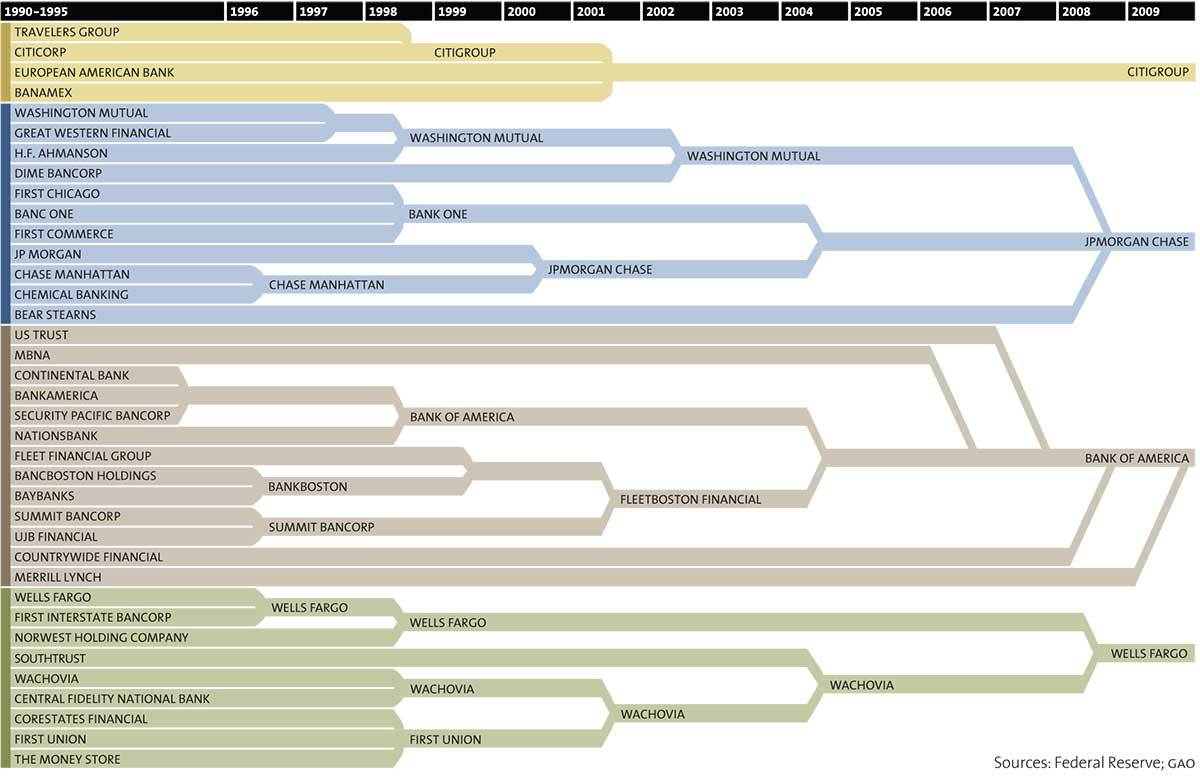

He then uses his perch to wage a media campaign that generates momentum and sets the stage for a trial or, in the majority of cases, a guilty plea. He has used similar tactics to snare miscreants on Wall Street, where his track record is even more impressive, winning more than 80 convictions and guilty pleas, although one of his insider-trading victories was thrown out on appeal last year.

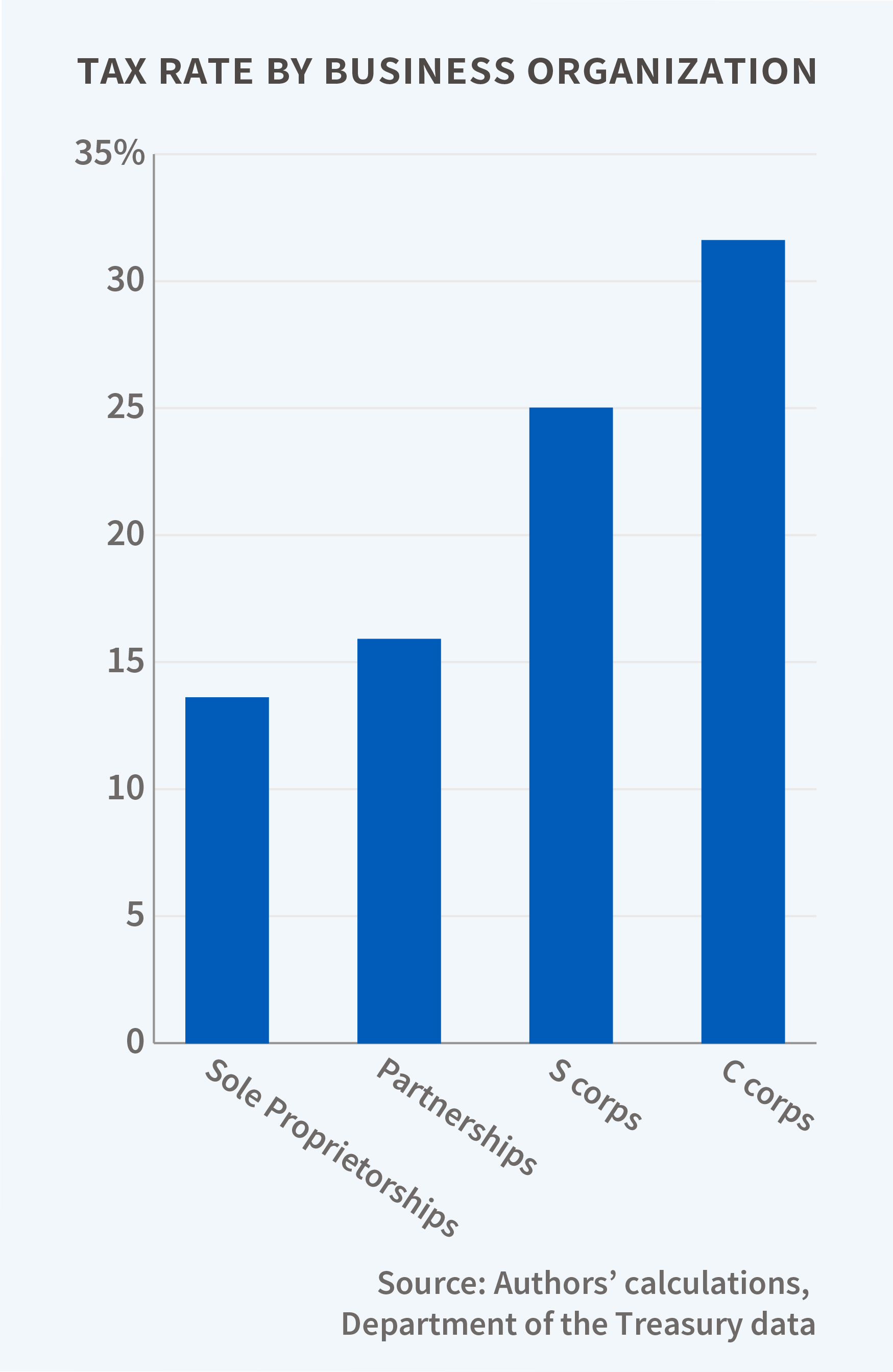

Bharara has won 11 corruption cases against state legislators by following the money.

In the NY Assembly the Chairman of the Ethics committee has never been allowed to hold a hearing. If you are allowed to have outside income, you can hide it as a bribe. If you oppose one of the leaders you are banished.

But you can not trade in exchange for getting something to line the pockets of yourself or a family member. You take an oath of office to serve the public. You are guilty of public corruption. Bharara is making sure these laws stick.