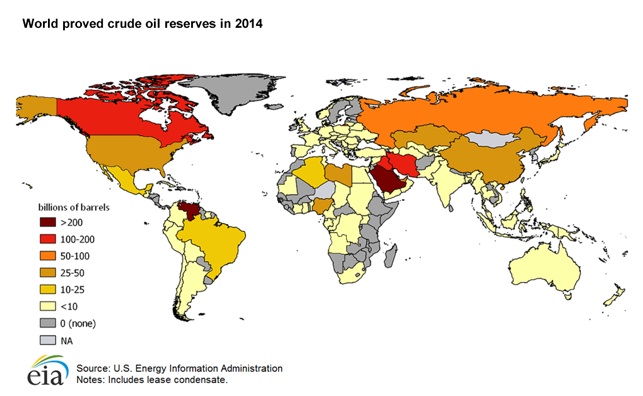

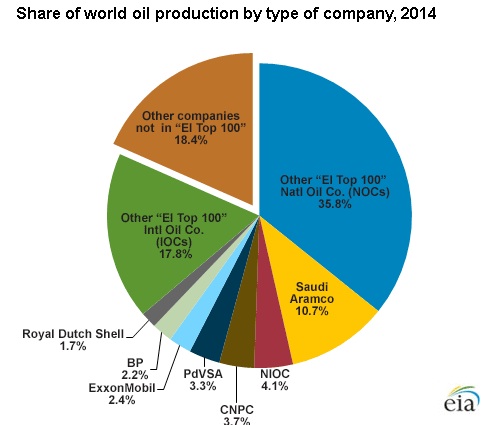

The world oil market is complex. Governments and private companies play various roles in moving oil from producers to consumers. Government-owned national oil companies (NOCs) control most of the world’s proved oil reserves (75% in 2014) and oil production (58% in 2014). International oil companies (IOCs), which are often stockholder-owned corporations, make up the balance of global oil reserves and production. Proved oil reserves consist of the amount of oil in a given area, known with reasonable certainty, that current technology can recover cost effectively. Worldwide proved oil reserves in 2014 were almost 1.7 trillion barrels, and global oil production averaged roughly 93.2 million barrels a day.

There are different types of oil companies

There are three types of companies that supply crude oil to the global market. Each type of company has different operational strategies and production-related goals:

- International oil companies (IOCs): These companies, which include ExxonMobil, BP, and Royal Dutch Shell, are entirely investor owned and primarily seek to increase their shareholder value. As a result, IOCs tend to make investment decisions based on economic factors. These companies typically move quickly to develop and produce the oil resources available to them and sell their output in the global market. Although these producers are affected by the laws of the countries in which they produce oil, all decisions are ultimately made in the interest of the company and its shareholders, not in the interest of a government.

- National oil companies (NOCs): These companies operate as an extension of a government or a government agency, and they include Saudi Aramco (Saudi Arabia), Pemex (Mexico), the China National Petroleum Corporation (CNPC), and Petróleos de Venezuela S.A. (PdVSA). These companies support government programs financially and sometimes strategically. These companies often provide fuels to domestic consumers at a lower price than the fuels they provide to the international market. These companies do not always have the incentive, means, or intention to develop their reserves at the same pace as investor owned international oil companies. Because of the diverse objectives of their supporting governments, these NOCs pursue goals that are not necessarily market oriented. The goals of these companies often include employing citizens, furthering a government’s domestic or foreign policies, generating long-term revenue to pay for government programs, and supplying inexpensive domestic energy. All NOCs belonging to members of the Organization of the Petroleum Exporting Countries (OPEC) fall into this category.

- NOCs with strategic and operational autonomy: The NOCs in this category function as corporate entities and do not operate as an extension of the government of their country. This category includes Petrobras (Brazil) and Statoil (Norway). These companies often balance profit-oriented concerns and the objectives of their country with the development of their corporate strategy. Although these companies are driven by commercial concerns, they may also take into account their nation’s goals when making investment or other strategic decisions.

In 2014, 100 companies produced 82% of the world’s oil. NOCs accounted for 58% of global oil production.