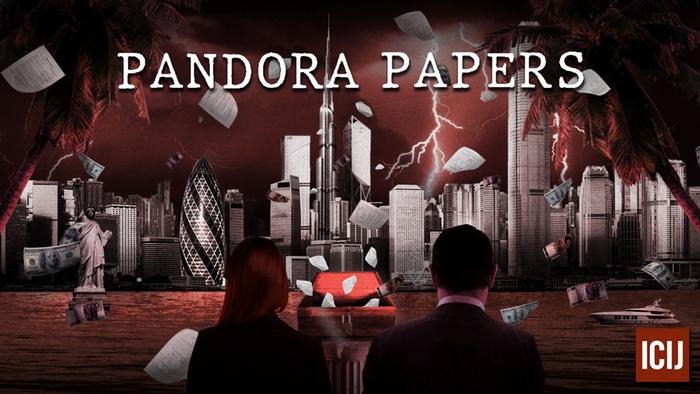

Offshore havens and hidden riches of world leaders and billionaires exposed in unprecedented leak

The Pandora Papers reveal the inner workings of a shadow economy that benefits the wealthy and well-connected at the expense of everyone else.

Millions of leaked documents and the biggest journalism partnership in history have uncovered financial secrets of 35 current and former world leaders, more than 330 politicians and public officials in 91 countries and territories, and a global lineup of fugitives, con artists and murderers.

The secret documents expose offshore dealings of the King of Jordan, the presidents of Ukraine, Kenya and Ecuador, the prime minister of the Czech Republic and former British Prime Minister Tony Blair. The files also detail financial activities of Russian President Vladimir Putin’s “unofficial minister of propaganda” and more than 130 billionaires from Russia, the United States, Turkey and other nations.

The leaked records reveal that many of the power players who could help bring an end to the offshore system instead benefit from it – stashing assets in covert companies and trusts while their governments do little to slow a global stream of illicit money that enriches criminals and impoverishes nations.

Among the hidden treasures revealed in the documents:…. icij.org/investigations/