In recent years, there has been a significant evolution in the formulation and communication of monetary policy at a number of central banks around the world. Many of these banks now present their economic outlook and policy strategies to the public in a more formal way, a process accompanied by the introduction of modern analytical tools and advanced econometric methods in forecasting and policy simulations. Official publications by central banks that formally adopt a monetary policy strategy of inflation targeting—such as the Inflation Report issued by the Bank of England and the monetary policy reports issued by the Riksbank and Norges Bank—have progressively introduced into the policy process the language and methodologies developed in the modern dynamic macroeconomic literature.

The development of medium-scale DSGE (dynamic stochastic general equilibrium) models has played a key role in this process.2 These models are built on microeconomic foundations and emphasize agents’ intertemporal choice. New York Federal Reserve DSCG Model

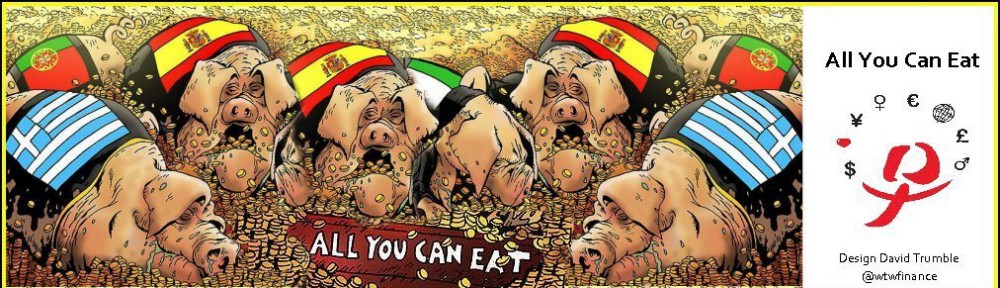

I don’t normally comment but I gotta say regards for the post on this amazing one :D.