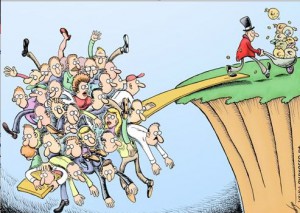

Yale economist Robert Schiller writes: Inequality insurance would require governments to establish very long-term plans to make income-tax rates automatically higher for high-income people in the future if inequality worsens significantly, with no change in taxes otherwise. I called it inequality insurance because, like any insurance policy, it addresses risks beforehand. Just as one must buy fire insurance before, not after, one’s house burns down, we have to deal with the risk of inequality before it becomes much worse and creates a powerful new class of entitled rich people who use their power to consolidate their gains.

To be truly effective, increases in wealth taxes – which fall more on highly mobile retired or other affluent people – would have to include a global component; otherwise, the rich would simply emigrate to whichever country has the lowest tax rates. And the unpopularity of wealth taxes has impeded global cooperation. Finland had a wealth tax but dropped it. So did Austria, Denmark, Germany, Sweden, and Spain.

Increasing wealth taxes now, as Piketty proposes, would strike many people as unfair, because it would amount to imposing a retroactive levy on the work carried out to accumulate that wealth in the past – a change to the rules of the game, and its outcome, after the game is over. Older people who worked hard to accumulate wealth over the course of their lifetime would be taxed on their frugality to benefit people who didn’t even try to save. If they had been told that the tax was coming, maybe they would not have saved so much; maybe they would have paid the income tax and consumed the rest, like everybody else.