The dark secret of global finance

Money laundering is no longer the preserve of criminal gangs – it’s a trillion-dollar business run through global financial centres.

There are three main methods by which criminal organisations and terrorist financiers move money for the purpose of disguising its origins and integrating it into the formal economy. The first is through the use of the financial system; the second involves the physical movement of money (e.g. through the use of cash couriers); and the third is through the physical movement of goods through the trade system. In recent years, the Financial Action Task Force has focused considerable attention on the first two of these methods. By comparison, the scope for abuse of the international trade system has received relatively little attention.

The international trade system is clearly subject to a wide range of risks and vulnerabilities that can be exploited by criminal organisations and terrorist financiers. In part, these arise from the enormous volume of trade flows, which obscures individual transactions; the complexities associated with the use of multiple foreign exchange transactions and diverse trade financing arrangements; the commingling of legitimate and illicit funds; and the limited resources that most customs agencies have available to detect suspicious trade transactions.

For the purpose of this study, trade-based money laundering is defined as the process of disguising the proceeds of crime and moving value through the use of trade transactions in an attempt to legitimise their illicit origins. In practice, this can be achieved through the misrepresentation of the price, quantity or quality of imports or exports. Moreover, trade-based money laundering techniques vary in complexity and are frequently used in combination with other money laundering techniques to further obscure the money trail. This study provides a number of case studies that illustrate how the international trade system has been exploited by criminal organisations. It also has made use of a detailed questionnaire to gather information on the current practices of more than thirty countries. This information focuses on the ability of various government agencies to identify suspicious activities related to trade transactions, to share this information with domestic and foreign partner agencies, and to act on this information.

The study concludes that trade-based money laundering represents an important channel of criminal activity and, given the growth of world trade, an increasingly important money laundering and terrorist financing vulnerability.

Moreover, as the standards applied to other money laundering techniques become increasingly effective, the use of trade-based money laundering can be expected to become increasingly attractive.

More on: Trade-Based-Money-Laundering-Trends-and-Developments /Egmont Group

The goal of the Egmont Group of Financial Intelligence Units (Egmont Group) is to provide a forum for financial intelligence unites (FIUs) around the world to improve co-operation in the fight against money laundering and the financing of terrorism and to foster the implementation of domestic programs in this field.

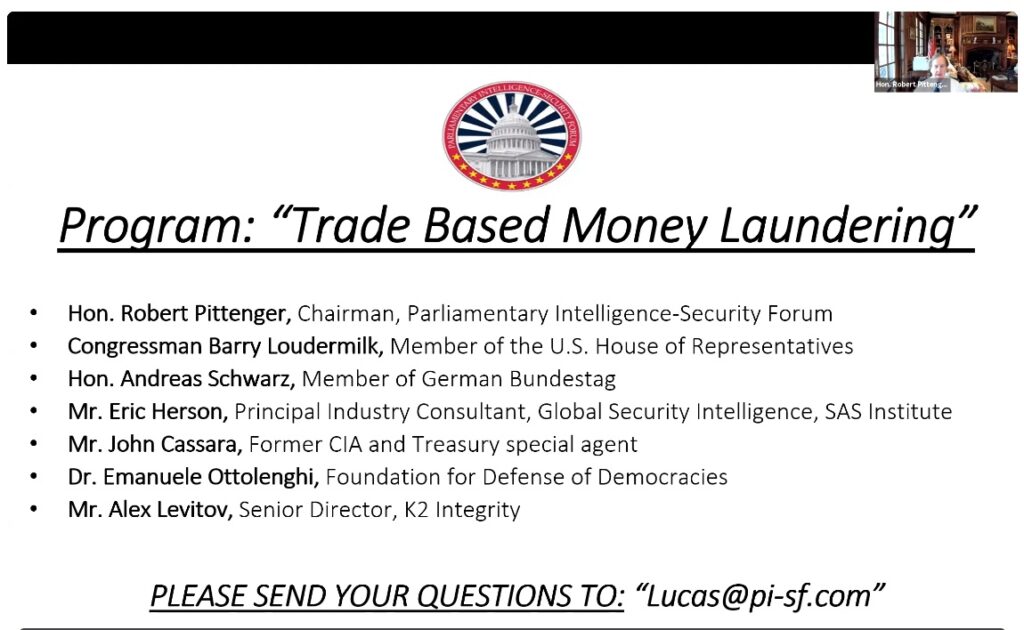

Trade Based Money Laundering /2016

Best Practices on Trade Based Money Laundering

Cartoon: Walt Handelsman