Category Archives: Entrepreneurs

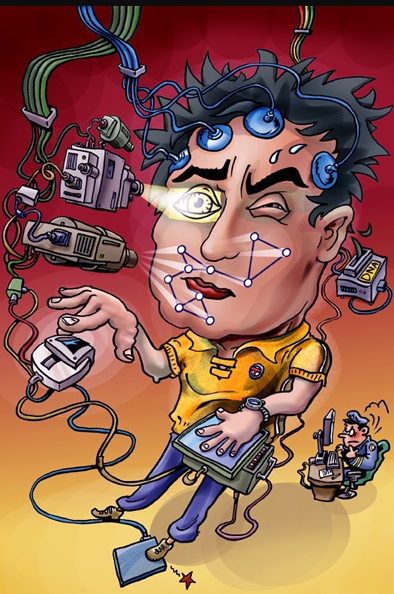

Entrepreneur Alert: Biometrics as ID

The use of biometrics to confirm identity is on the rise.

The Atlanta Fed reports: The use of physical characteristics to identify people – biometrics – is older than flying machines. Seeking a way to identify repeat criminal offenders so as to mete out harsher punishments, a police inspector in England in the 1880s devised a system of measuring criminals’ arms, heads, and other features. Then crime fighters began fingerprinting suspects a couple of decades later.

Today, a smart phone can have a fingerprint reader to prove you’re you when you make a payment over the phone. Consumers can now choose from more than a dozen “mobile wallets,” essentially payment mechanisms built into mobile phones. Numerous big technology and financial firms have rolled out payment apps that use biometrics. And many information security experts contend,that it is time to retire passwords as an authentication tool.

A boom in mobile payments and biometrics, long promised by industry boosters, could be dawning. That was among the themes that emerged from the Risk Forum’s November forum, “Banking on Biometrics: Bye-Bye Passwords?” The one-day forum explored the present and potential of biometrics as a verification tool for payments and banking.

Verifying a person’s identity generally encompasses some combination of three elements:

- Something you have (a payment card, for example)

- Something you know (a PIN or password)

- And something you are (your fingerprint, iris, and so on)

So far the first two have served the U.S. payments system reasonably well, Lott pointed out. Some of the technological advances are fascinating. Many sensors now include “liveness” detection. For instance, many facial recognition sensors require that you blink to be sure your face picture is real and not a three-dimensional mask, and advanced fingerprint readers detect blood flow.

Meanwhile, consumers have become more receptive to biometrics, Jain said. That growing level of acceptance seems to be evident in the marketplace. USAA, the first financial services firm to offer fingerprint, voice, and facial recognition for mobile banking apps, has garnered more than a million users for its biometric system.

And smart phone payment systems appear to be catching on. Jain said Apple Pay is supported by more than 300 banks, while Android Pay is accepted at more than a million stores.

“Biometrics are changing the way we conduct everyday transactions,” Jain said, “and now the focus is on payments.”

Nothing, including biometrics, promises 100 percent security. One of the keys to solid authentication, several conference speakers noted, is to figure ways to block imposters even if they have compromised biometrics, which sometimes can be done with photos or even 3-D masks on less-sophisticated systems.

The real key to biometrics becoming ubiquitous is straightforward: they must offer real security and be easy to use.

As Cuba Opens, Can Baseball Drafts Be Far Behind?

Opening Cuba. When US Secretary of Commerce Penny Pritzer arrived in Cuba, she invited her hosts to watch her team, the Chicago Cubs, in post season. Fidel Castro was reportedly a very good baseball pitcher. If he and George W. Bush had been able to sit down and arrange for Cuban baseball stars to play for American teams, Cuba might have opened for US business more than a decade ago.

Teams meeting in Washington “have made important advances in negotiating a memorandum of understanding on establishing regular flights between Cuba and the United States, and shortly they will be ready to announce a preliminary agreement on this issue”, Josefina Vidal, head of North American affairs for Cuba’s foreign ministry, told reporters in Havana. So is the expanded public Internet access that Cubans now enjoy, something the Cuban government agreed to as part of the deal struck between President Obama and Cuban President Raúl Castro a year ago. This deal is the result of months of negotiations between the two countries and paves the way for US airlines to eventually sell flights to Cuba directly from their websites for greater tourism which is still barred by USA law. It said a stronger USA civil aviation relationship with Cuba is a “critical component” of Obama’s effort to normalize relations between the two countries, which have already reopened embassies in Havana and Washington.

Some members of Congress marked the first anniversary of Obama’s opening to Cuba by hailing the impact of the “small steps” that Cubans and American have taken toward each other. American has operated charter service to Cuba since 1991, flying from Miami, Tampa and Los Angeles to the Cuban cities of Camaguey, Cienfuegos, Havana, Holguin and Santa Clara. Diplomatic exchanges between the USA and Cuba came to a screeching halt in 1961 when Washington announced that it would be breaking off its ties with Havana. “This is as much a political document as it is a transportation document”, he said.

Tony Castro, the youngest son of former Cuban president Fidel Castro, says baseball is helping Cuba and the United States to reunite. “We look forward to offering service between our global gateways and Cuba as soon as we have approval to do so”, airline spokesman Charles Hobart said in an email. This oversight is now managed by licensed People-to-People tour operators who use charter companies for their air travel to Cuba. “The atmosphere of relaxation makes it easier for Cuba to diversify its economic relations beyond just Venezuela”, its main ally and trade partner, said Jorge Duany, an expert at the Florida International University’s Cuban Research Institute. Other U.S. airlines – American Airlines Group Inc, Delta Air Lines Inc and United Continental Holdings Inc – have expressed interest in scheduling flights to Cuba. Since Obama eased restrictions on travel, USA visits to Cuba have climbed more than 70 percent, with 138,000 arrivals in the first 11 months of 2015.

Entrepreneur Alert: Alliance with Government for Clean Energy Projects

Mariana Mazzucato writes: The global agreement reached in Paris last week is actually the third climate agreement reached in the past month. The first happened at the end of November, when a group of billionaires led by Bill Gates, Mark Zuckerberg, and Jeff Bezos announced the creation of a $20 billion fund to back clean-energy research. On the same day, a group of 20 countries agreed to double their investment in green energy, to a total of $20 billion a year.

Of the two pre-Paris announcements, it was that of the Breakthrough Energy Coalition (BEC) grabbed the headlines. If a technological breakthrough is needed in the fight against climate change, whom should we expect to provide it, if not the wizards of Silicon Valley and other hubs of free-market innovation?

On its own, the free market will not develop new sources of energy fast enough. The payoff is still too uncertain. Just as in previous technological revolutions, rapid advances in clean energy will require the intervention of a courageous, entrepreneurial state, providing patient, long-term finance that shifts the private sector’s incentives. Governments must make bold policy choices that not only level the playing field, but also tilt it toward environmental sustainability.

Advances in clean energy will require the involvement of both the public and the private sector. Because we do not yet know which innovations will be the most important in decarbonizing the economy, investment must be allocated to a wide array of choices. Long-term, patient finance must also be available to help companies minimize uncertainty and bridge the so-called “Valley of Death” between basic research and commercialization.

The BEC’s argument – that the “new model will be a public-private partnership between governments, research institutions, and investors” – shines a welcome spotlight on the relationship. Unfortunately, however, aside from Gates and his colleagues, there are few signs that the private sector can be counted on to lead the way.

The energy sector has become over-financialized; it is spending more on share buybacks than on research and development in low-carbon innovation. The energy giants ExxonMobil and General Electric are the first and tenth largest corporate buyers of their own shares. Meanwhile, according to the International Energy Agency, just 16% of investment in the US energy sector was spent on renewable or nuclear energy. Left to their own devices, oil companies seem to prefer extracting hydrocarbons from the deepest confines of the earth to channeling their profits into clean-energy alternatives.

Meanwhile, government R&D budgets have been declining in recent years – a trend driven partly by under-appreciation of the state’s role in fostering innovation and growth, and more recently by austerity in the wake of the 2008 financial crisis.

The main public-sector bodies playing a leading role in promoting the diffusion of green-energy technologies are state development banks. Indeed, Germany’s KfW, the China Development Bank, the European Investment Bank, and Brazil’s BNDES are four of the top ten investors in renewable energy, amounting to 15% of total asset finance.

The public sector can – and should – do much more. For example, subsidies received by energy corporations could be made conditional on a greater percentage of profits being invested in low-carbon innovations.

While charitable donations by billionaires certainly should be welcomed, companies should also be made to pay a reasonable amount of taxes. After all, as the BEC’s manifesto points out, “current governmental funding levels for clean energy are simply insufficient to meet the challenges before us.” And yet, in the UK, for example, Facebook paid just £4,327 in tax in 2014, far less than many individual taxpayers.

The willingness of Gates and other business leaders to commit themselves and their money to the promotion of clean energy is admirable. The Paris deal is also good news. But they are not enough.

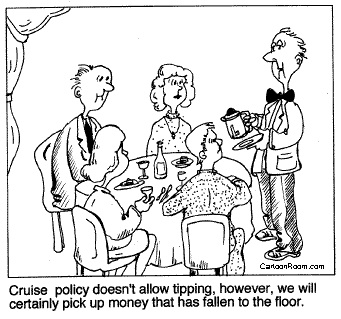

Tipping Rules and Inequality

Tipping and inequality. Danny Meyer, a premier New York restauranteur is abandoning tipping. He will put a flat 20% on bills.

Danny Meyee owns 13 restaurants including The Modern, said the tipping system was unfair as it only benefited a few restaurant workers.

Waiting staff in the US typically receive most of their wages in tips, but cooks and other workers do not.

Mr Meyer plans to start the policy at four of his restaurants next month.

“We believe hospitality is a team sport, and that it takes an entire team to provide you with the experiences you have come to expect from us,” Mr Meyer said in a statement.

Menu prices will increase 25% to 35% to account for the changes.

Restaurants in the US are rethinking how they compensate their employees for a number of reasons.

In major US cities like New York, Chicago and San Francisco, restaurants are finding it hard to retain kitchen staff as the cost of living in those areas increases.

Because of tips (typically 20% of each bill), servers sometimes end up earning much more than highly skilled cooks.

Restaurant workers across the US have also been lobbying for better wages in recent years. New York City and other cities and states have increased their minimum wage in response.

Some high-end restaurants in the US have already stopped accepting tips, but Mr Meyer’s empire is the most prominent restaurant group to date to embrace the move.

Melissa Fleischut, president and CEO of the New York State Restaurant Association, said Mr Meyer’s decision could have a ripple effect in the industry.

“I think that because it is Danny Meyer and he is considered a leader in the restaurant industry, that a lot of people are going to look at this move,” she said.

P2P Lending Important in China

Liu Mengkang writes: Last month, China’s leaders revealed details of the 13th Five-Year Plan, which will guide the economy’s trajectory until 2020. Gone are the directives to expand industrial production at a breakneck pace that characterized previous five-year plans. Now, the focus is on achieving sustainable long-term growth, underpinned by domestic consumption, a stronger services sector, entrepreneurship, and innovation.

The Internet – which already has more than 680 million active users in China – will play a key role in facilitating this shift. In particular, online peer-to-peer (P2P) lending, a streamlined approach to credit allocation, may hold the key to expanding and deepening China’s financial sector, enabling firms to grow and innovate, and bolstering domestic consumption. P2P Lending in China

US Court Says Online Fantasy Sports Gambling

A decision came down supporting NY State’s case against the fantasy sports business. As with many aspects of the new economy and technology active in areas where the ordinary citizen has an opportunity to invest for profit or loss, we wonder where lines are drawn.

Under New York Penal Law 225.00, “gambling” is defined as the staking or risking of something of value on the outcome of either (1) “a contest of chance,” or (2) “a future contingent event not under [that person’s] control or influence,” each with the agreement or understanding that the person will receive something of value in the event of a certain outcome. (At least eight other states employ the same test: Alabama, Alaska, Hawaii, Missouri, New Jersey, Oklahoma, Oregon and Washington.)

This definition sets forth two separate categories of gambling: (1) wagering on a “contest of chance,” and (2) wagering on the outcome of a “future contingent event” over which the bettor has no “control or influence.” The latter of these two categories is not dependent on a “skill vs. chance” assessment, but, rather, looks to whether an alleged bettor can “control” or “influence” the outcome of the “future contingent event.”

The statute, however, does not define these words. But the plain meaning of the words “control” and “influence” would seem to connote being able to have an “impact” or an “effect” on the event itself, which brings us back to the ultimate question: What is the “future contingent event” in a DFS contest? Is it the real-world sporting event or events on which scoring is based? Or is it the DFS contest itself?

Entrepreneur Alert: Diamonds are A Girl’s Best Friend?

Prices of diamonds have been lackluster for a while. In Botswana, the second largest diamond yet discovered, plucked from the earth’s depths by machines, will probably fetch a very good price. It may even be sold on its own at auction.

The only larger stone discovered to date was in 1905 in South Africa. It is part of the British crown jewels.

It is projected that Global diamond production is expected to peak in 2017, when 164 million carats of diamonds are forecast to be produced, according to McKinsey & Co. After that, production is expected to go into a long-term decline, unless significant new discoveries are made, McKinsey’s forecasts show. Is there room for an entrepreneurial move here?

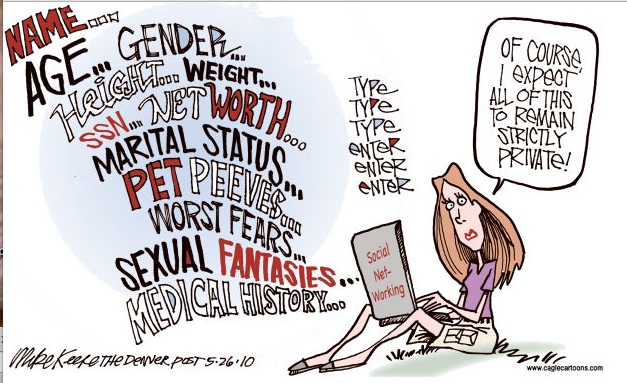

Entreprenuer Alert: Privacy in the Social Media

Europeans are concerned about privacy and particularly young people in the US tend not to be. Providing security on the internet is a good and growing global business.

Facebook will stop tracking browsers of Facebook pages in Belgium who are not signed into a Facebook account, seeking to comply with a court ruling last month ordering it to do so or face daily fines.

The company’s action means Belgians will have to log into Facebook before they can see Facebook pages, forcing them to create and sign into an account if they want to view the pages or related content.

Previously non-users could view public Facebook pages from sports teams, celebrities, tourist attractions and businesses without needing to log into Facebook. As a result of the changes registered Facebook users in Belgium who attempt to log in from an unrecognised web browser will be forced to comply with some added security steps, the company said.

At issue is Facebook’s use of a so-called “datr” cookie, which it places on users’ browsers when they visit Facebook or click a Facebook “Like” button on other sites, allowing it to track the activities of that browser.

Facebook says the tiny bit of software code only identifies browsers, not individuals, and helps Facebook to distinguish legitimate visits from those by attackers.

“(Removing the cookie) will cause a marginal privacy hit. That will decrease the privacy of Belgian users,” Facebook chief security officer Alex Stamos said last month.

Facebook is appealing the ruling.

Belgium’s data protection regulator took the US company to court in June, accusing it of trampling on EU privacy law by tracking people without a Facebook account without their consent.

Facebook plans to appeal against the court ruling but, in complying with the order, expects it will no longer face a €250,000 (£177,000) daily fine.

The company has argued that Belgium has no authority on this issue, since it has its European headquarters in Ireland and as such should be policed solely by regulators there.

Belgium’s privacy regulator said the fact that the Brussels court had ruled meant it had jurisdiction over the company. The changes will be implemented as soon as the regulator serves Facebook with the order, expected sometime this week.

Entrepreneur Alert: Streaming Media Content

Delivery of media content is a wide open field for entrepreneus:

Greg Miller writes: If you’re a Star Trek fan, CBS just made your day. It announced that it’s bringing back a Star Trek television series.

But there’s a catch…

In a sign of the changing times in the TV industry, the only way to see the new series will be to subscribe to CBS All Access – the company’s paid video streaming service that costs $5.99 a month.

As you may know, the video streaming market is huge – and growing. It certainly qualifies as a disruptive force, as it’s a direct threat to incumbent cable companies, with viewers increasingly “cutting the cord” on their cable programming.

At the same time, though, it’s also a huge opportunity for cable companies because many of them not only own the programming, they also provide the internet connections that enable streaming to reach homes. And nobody wants to cut that cord!

But as the streaming industry grows, it presents a challenge to other streaming companies, content producers, and consumers’ wallets.

Before blockbuster franchises like Harry Potter and Twilight, Star Trek was the original franchise. Indeed, for a time in the 1990s, Star Trek was even called the franchise within Paramount Studios.

When Viacom Inc. split up its company in 2014, the franchise split. Paramount kept the movie rights and has since produced two successful Star Trek films. CBS Television kept the TV rights, and it’s getting back in the game.

But CBS’ decision to only stream the new series is a direct shot at two parties:

Cable Companies: Any high-profile programming that isn’t available on cable is a direct threat to cable. After all, if the shows you want to watch are increasingly available elsewhere, why give your money to a cable company, which you probably hate anyway.